Africa’s Commercial Aviation Expansion: 2025 Capacity, Airlines, and Hub Shifts

- oways.saleh

- 0 Comments

Africa’s aviation sector entered 2025 with signs of steady and broad-based growth. Unlike previous years where discussions often revolved around post-pandemic recovery, today’s market dynamics reflect something more fundamental: a structural expansion of commercial aviation.

Across Africa, airlines are adding capacity, hubs are growing in strength, and connectivity patterns are diversifying toward Asia, Europe, and the Middle East.

According to the latest August 2025 schedule data, capacity across African airlines and airports has grown year-on-year, supported by both incumbent full-service carriers and emerging low-cost and regional challengers.

This expansion is not concentrated in one subregion. Hubs in North, East, West, and Southern Africa are all experiencing growth, albeit unevenly.

The following analysis breaks down the busiest airports, largest airlines, and international flows shaping African aviation in 2025.

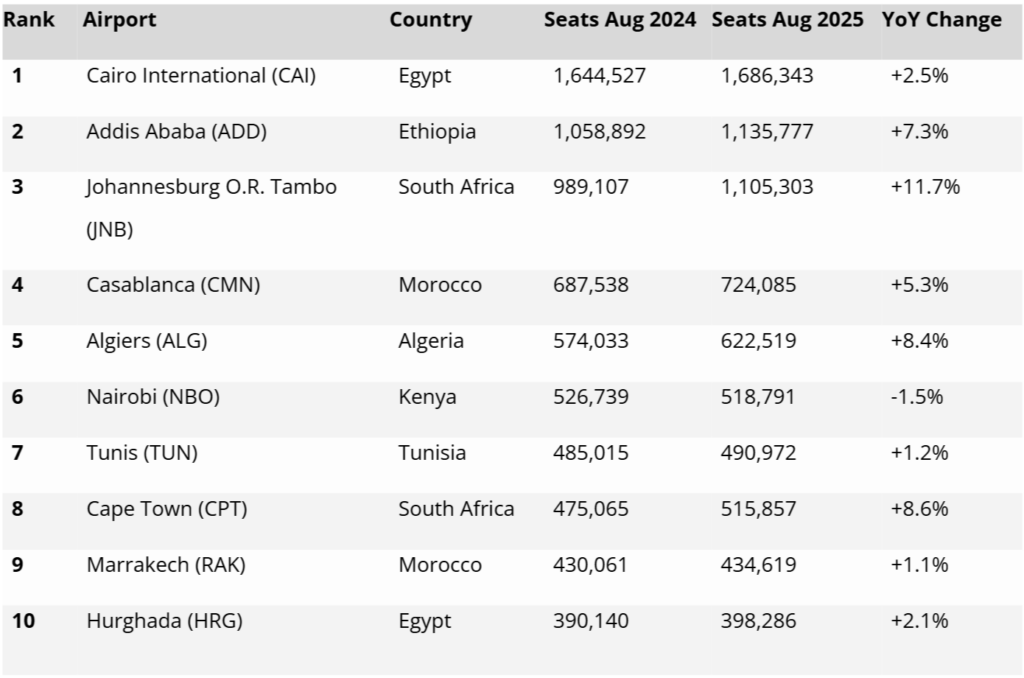

1. Busiest Airports in Africa (August 2025)

The top ten busiest African airports by departing seats show a healthy balance across North, East, and Southern Africa, with Cairo, Addis Ababa, and Johannesburg leading the way.

Key Trends

- North Africa Dominance: Cairo remains the busiest airport in Africa (1.68M seats), consolidating Egypt’s strategic location as a gateway between Europe, the Middle East, and Africa. Casablanca and Algiers also post strong growth (+5.3% and +8.4%), fueled by Europe-Africa connectivity.

- East Africa Shifts: Addis Ababa (+7.3%) has strengthened its hub role for Ethiopian Airlines, but Nairobi (-1.5%) slipped, reflecting competition from Addis and Gulf carriers.

- Southern Africa Resurgence: Johannesburg (+11.7%) is Africa’s fastest-growing major hub, while Cape Town (+8.6%) underscores the rebound of South Africa’s tourism and regional travel.

- Tourism-Driven Growth: Marrakech and Hurghada are gaining due to leisure demand from Europe and intra-Africa tourism flows.

Insight: Johannesburg’s double-digit growth positions it as a resurgent continental hub, potentially challenging Addis and Cairo for broader pan-African connectivity.

2. Leading Airlines in Africa (August 2025)

The airline capacity rankings highlight the continued dominance of Ethiopian Airlines, but also reveal rapid growth from West Africa’s Air Peace and stronger positions for North African flag carriers.

Key Trends

- Ethiopian Airlines Expansion: With nearly 2 million departing seats (+14.1%), Ethiopian remains Africa’s largest and most globally connected carrier, leveraging Addis as a super-hub.

- Low-Cost Power: Safair (938k seats) maintains its lead as Africa’s largest LCC, focusing mainly on South African domestic routes.

- North African Growth: EgyptAir, Royal Air Maroc, and Air Algérie all posted growth above 4%, reflecting stable European demand.

- West Africa’s Rising Star: Nigeria’s Air Peace expanded capacity by 53.4%, marking the fastest growth among African airlines. Its intercontinental ambitions are reshaping West Africa’s aviation landscape.

- Pressure Points: Airlink (-10%) and Kenya Airways (-1.3%) contracted slightly, showing challenges from LCCs and competition from Gulf/East African carriers.

- Foreign Influence: Ryanair (+24.4%) is ramping up North African leisure routes, while Emirates (+9.4%) strengthens its Africa–Middle East connectivity.

Insight: Air Peace’s surge underscores West Africa’s potential to challenge traditional aviation powerhouses in North and East Africa.

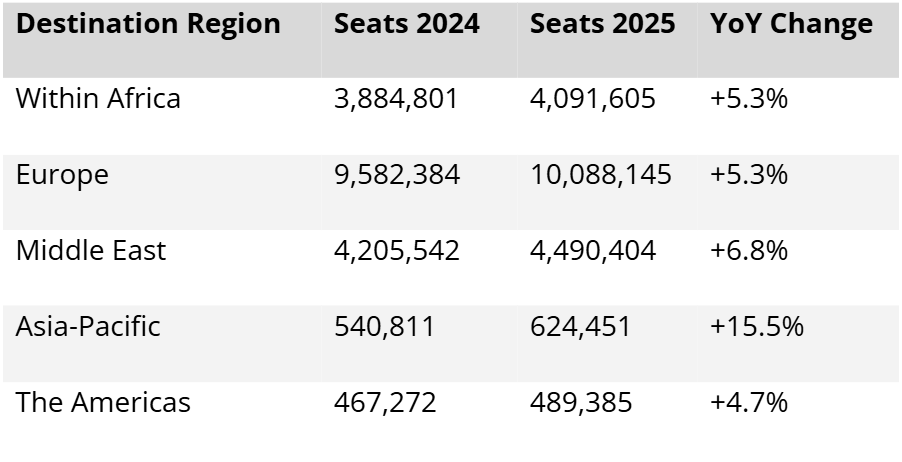

3. Africa’s Connectivity by Region

Where do flights from Africa go? The August 2025 schedule data highlights Europe’s continued dominance, but also points to Asia-Pacific as the fastest-growing market.

Key Trends

- Europe Still Dominant: At 10.1M seats, Europe accounts for nearly half of Africa’s intercontinental traffic, underpinned by strong links from North Africa.

- Middle East Strengthens: With 4.49M seats (+6.8%), the Middle East remains a key connecting market, heavily driven by Gulf carriers (Emirates, Qatar Airways, and flydubai).

- Intra-African Connectivity: At 4.09M seats, intra-African travel is growing (+5.3%) but still limited compared to intercontinental flows, showing the importance of initiatives like the African Union’s Single African Air Transport Market (SAATM).

- Asia-Pacific Surge: Capacity rose 15.5% YoY — the fastest among all regions driven by demand from China and India, as well as Ethiopian and Gulf carriers expanding Asia services.

- The Americas Steady: Capacity to the Americas remains modest (489k seats, +4.7%), but growing steadily through hubs in West Africa and Addis Ababa.

Insight: Africa–Asia connectivity is growing faster than any other region, signaling a potential long-term realignment of trade and travel flows.

4. Strategic Shifts in Africa’s Aviation Landscape

The data reveals several key dynamics shaping Africa’s commercial aviation sector:

1. Hub Competition Intensifies

- Cairo remains Africa’s busiest airport, but Johannesburg (+11.7%) and Addis Ababa (+7.3%) are gaining.

- Nairobi’s slip (-1.5%) highlights East Africa’s competitive pressures.

2. Airlines Reshaping Regional Power

- Ethiopian Airlines dominates, but Air Peace’s +53.4% surge positions Nigeria as a new aviation growth center.

- South African carriers show mixed fortunes: Safair steady, Airlink contracting.

3. Connectivity Beyond Europe

- While Europe is still the largest market, Asia-Pacific’s rapid expansion (+15.5%) signals a shifting balance.

- Gulf carriers remain critical partners in Africa’s connectivity to Asia and the Middle East.

4. Intra-African Growth Opportunities

- Despite growth, intra-African connectivity (4.09M seats) still lags intercontinental capacity.

- Regional initiatives such as SAATM and LCC expansion are essential for unlocking Africa’s domestic aviation potential.

Outlook for African Aviation

The outlook for Africa’s aviation sector in 2025 and beyond is broadly positive, but shaped by several themes:

- Diversification of Hubs: Growth is no longer concentrated in North Africa; Southern and West Africa are becoming stronger players.

- Rise of LCCs: Safair and other low-cost models are expanding affordability within domestic and regional markets.

- Geopolitical Shifts: Increased Asia-Pacific demand suggests stronger Africa–Asia trade and people flow.

- Infrastructure Challenges: Airport infrastructure across parts of Africa remains under strain; future growth depends on continued investment.

- Policy Integration: Full implementation of SAATM remains critical to reduce barriers and costs for intra-African travel.

Conclusion

Africa’s aviation sector in 2025 is expanding, diversifying, and positioning itself as a more integrated part of global aviation flows. Cairo, Addis Ababa, and Johannesburg remain anchor hubs, but challengers like Air Peace and growing Southern African hubs are reshaping the balance of power.

With Europe still dominant, the Middle East strengthening, and Asia-Pacific demand accelerating, Africa’s aviation future lies in building deeper intercontinental connectivity while unlocking its vast intra-African market. The data shows a sector that is poised to become a vital driver of economic integration, tourism, and global trade in the decade ahead.

Data sources:

- OAG Aviation Worldwide Limited

- African Airlines Association (AFRAA)