Aviation India: Data-Driven Growth with The Middle East Connection

- oways.saleh

- 0 Comments

India’s aviation sector is entering a defining phase, one that blends scale with strategy, and ambition with global collaboration. For Tahseen Aviation Services, the developments taking shape across India are not merely statistics of growth; they represent the evolution of a regional ecosystem that the Middle East has long helped sustain.

The partnership between India and the Gulf has matured from a network of transit routes into a cornerstone of global connectivity. As India modernizes its airports, expands its fleets, and deepens international cooperation, the Middle East remains its most reliable gateway supporting air traffic flows, cargo corridors, and operational resilience.

From a flight support perspective, this connection reflects shared priorities in safety, efficiency, and seamless cross-border operations that continue to define the next era of aviation growth.

Why the Middle East Matters for India

Traffic levels in 2024 surpassed 2019 by 10.9%, marking a fourth straight year of double-digit expansion, and positioning India among the world’s fastest-growing markets by origin-destination passengers.

At the same time, the Middle East has become India’s single largest international market by destination region, accounting for 39% of international O-D passengers in 2024. A reality that shapes fleet strategy, airport investments, and network design on both sides of the Arabian Sea.

Below is a data-focused snapshot of where India is now, what’s changing in real time, and how the India–Gulf corridor underpins the next phase of growth.

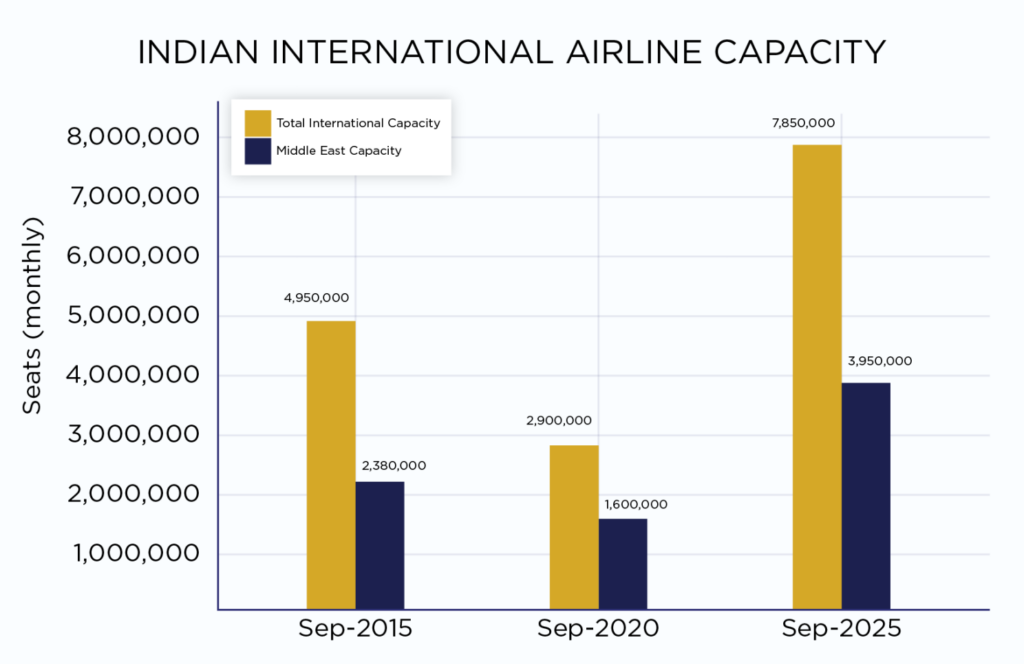

Insight: India’s international airline capacity has grown steadily over the past decade, with the Middle East maintaining a dominant share of that growth.

In September 2015, Indian carriers allocated roughly 48% of their international capacity toward Middle Eastern destinations. A proportion that, despite temporary pandemic disruptions in 2020, has remained consistently high through 2025.

The latest data shows both total international capacity and Middle East-bound seats reaching record levels, signaling not just recovery but structural interdependence between the two regions. This sustained growth underlines the Middle East’s continued role as India’s primary aviation corridor essential for connecting Indian traffic to Europe, Africa, and the Americas.

Where India’s Aviation Market Stands Today

Demand and traffic trajectory

Multiple datasets confirm the momentum. IATA’s India briefing indicates that traffic is expected to exceed pre-pandemic baselines by 10.9% in 2024. DGCA-cited reporting for 2025 (Jan–Aug) shows domestic passenger volumes up ⁓5% YoY, despite a soft August, indicating evidence of resilience amid operational and macroeconomic noise.

Macro tallies for 2024 put India at 174–241 million total passengers, underscoring both the scale and pace of catch-up; either way, the market is firmly inside the world’s top tier.

Capacity mix

Low-cost carriers (LCCs) dominate India’s seat map. As of late 2025, LCCs account for 70% of Indian capacity (18.1 million seats vs. 7.9 million for full-service in OAG’s monthly snapshot), shaping fare levels, aircraft selection, and secondary city penetration.

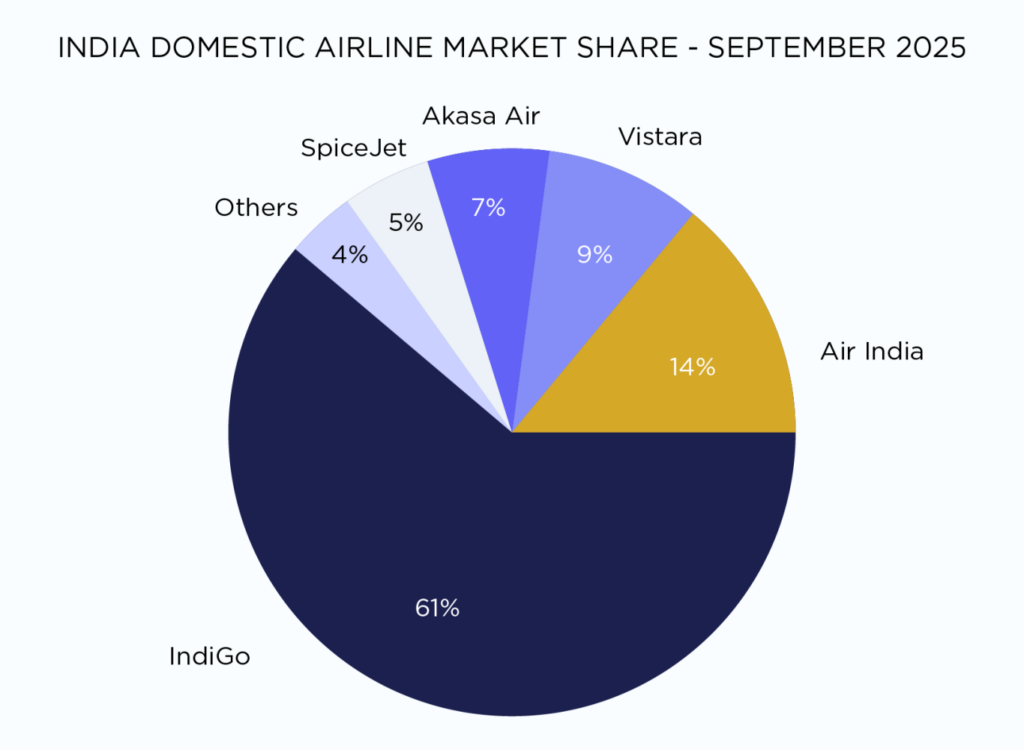

Insight:

India’s domestic aviation market continues to be characterized by consolidation and strong leadership from IndiGo, which now commands roughly 60% of total market share.

The merger of Air India and Vistara under the Tata Group has begun reshaping the competitive landscape, giving rise to a formidable full-service contender.

Meanwhile, Akasa Air’s steady growth highlights rising demand for flexible, customer-friendly low-cost options. Although smaller carriers like SpiceJet and regional operators retain niche positions, the overall structure of India’s domestic market reflects a maturing ecosystem.

International lift

India’s international capacity reached 7.3 million seats in April 2024, which is +17% higher vs Apr-2019 and keeps climbing. On a country-pair basis, the UAE is India’s busiest international market, with about 28% of international seats in October 2025, far ahead of the next-largest market (Thailand at 8%).

Infrastructure: The Airport Build-Out is Accelerating

On October 8, 2025, India inaugurated Navi Mumbai International Airport, which begins operations with 20 million passengers/year in Phase 1, scaling to 90 million as subsequent phases making Mumbai a rare Indian city with two international airports and relieving one of the country’s most constrained metro systems.

The Noida (Jewar) International Airport serving the NCR is slated to start operations with 12 million passengers/year in Phase 1, planning a long-term build-out to 60–120 million by 2050. A dedicated AISATS cargo hub (initial 250,000 tonnes/year) is being commissioned alongside, anchoring pharma, perishables, and e-commerce flows and signaling intent to couple passenger growth with freight competitiveness from Day 1.

India’s UDAN program has moved from pilot to scale. As of October 2025, 649 routes have been operationalized, connecting 93 underserved airports (plus 15 heliports and 2 water aerodromes) and carrying 15.6 million passengers on 323,000 UDAN flights bolstering Tier-II/III demand that ultimately feeds trunk routes and international hubs.

Fleet, Orders and What They Signal

Mega Orders

India’s two largest carriers have locked in long arcs of capacity:

- Air India has orders and commitments now totaling 570 aircraft (split across Airbus/Boeing) as part of its Vihaan.AI transformation, re-fleeting narrow and wide bodies to rebuild global relevance.

- IndiGo placed a record 500 A320-family order in 2023, taking its backlog near 1,000 aircraft; it then entered the widebody race in 2024 with 30 A350-900s and doubled that to 60 A350s in October 2025, explicitly targeting long-haul flows currently dominated by Gulf carriers.

OEM outlook

Boeing’s 2025 market outlook projects 2,835 new aircraft for India and South Asia over 20 years, heavily single-aisle, but with notable widebody growth to support long-haul expansion and cargo.

Implication

These orderbooks are not just about domestic growth; they’re a bid to retain more international flows on Indian liveries, particularly to Europe and North America, while still leveraging Gulf hubs for connectivity and redundancy.

Real-Time Middle East Linkages

- The Middle East is India’s number one international region. In 2024, the Middle East captured 39% of India’s international O-D traffic (14.9m pax), eclipsing Asia-Pacific (30%), Europe (15.5%), and North America (12.6%).

- The UAE alone commands 28% of India’s international seats in Oct-2025, reflecting dense city-pair webs (Mumbai, Delhi, Kochi, Kozhikode, Hyderabad, Chennai, etc.) and the diaspora/business base underpinning year-round demand.

- Hub effects. Dubai International (DXB) handled 92.3 million passengers in 2024; India was its top country market with 12 million passengers, illustrating just how integral India is to Gulf hub volumes and vice versa.

- India is selectively expanding bilateral capacity; for instance, Kuwait–India weekly seats were raised 50% (to 18,000), the first hike in 18 years, supporting additional frequencies and city-pairs across the Gulf.

- ACI projects ⁓5.9% passenger growth for the Middle East in 2025, sustaining the hub capacity India taps for one-stop access to Europe/Africa/Americas while Indian carriers scale up long-haul.

Projections: What the Next 5–10 Years Look Like

Short-to-mid-term (to FY2030)

Knight Frank/industry modeling suggests India’s air passengers could reach ⁓600 million by FY2030 (from ⁓412m in FY2025), contingent on aircraft deliveries, airport commissioning, and macro stability.

The capex bill to enable this is pegged above $170 billion by 2030 in S&P Global Ratings analysis (about $150b for ⁓1,700 aircraft and $24b for airports).

Longer arc (to 2035)

IATA-referenced scenarios widely point to doubling India’s passenger traffic by 2035, with India already the third domestic market and moving up global ranks as incomes and urbanization rise.

Middle East role in the forecast

Even as Indian carriers upgauge for non-stops to Europe and North America, the Gulf hubs remain essential for:

- Network breadth

- Redundancy during fleet/slot constraints

- Cargo connectivity

- Secondary-city internationalization (one-stop).

What This Means for Operators and Flight-Support Teams

I. Network and scheduling strategy.

With the Middle East holding 39% of India’s international O-D flows and the UAE at 28% of seats, planners should prioritize bilateral entitlements, night-bank arrivals, and crew/maintenance positioning around UAE/Qatar/Saudi nodes to secure high-reliability transfer windows.

II. Airport choice and slots.

The commissioning of Navi Mumbai and the ramp-up of Noida (Jewar) will gradually diversify metro capacity in Western and Northern India. Early slot strategies and ground-handling partnerships at these airports (plus established metros) will be a competitive advantage for both scheduled and charter operations.

III. Cargo readiness.

As Noida’s 250,000-tonne cargo hub opens, pharma/perishables exporters gain a North India gateway that dovetails with Gulf cool-chain networks. Aligning block times with freighter waves at DOH/DXB/AUH/JED can unlock yield without compromising schedule integrity.

IV. Fleet and fuel risk.

Rapid narrow-body deliveries (IndiGo) alongside wide-body re-fleet (Air India, IndiGo A350s from 2027) will increase long-haul lift but keep India’s short/medium-haul dependent on LCC economics; hedging for ATF volatility and FX exposure remains pivotal.

V. Policy watch.

Bilateral seat increases (e.g., Kuwait +50%) can quickly change route math. Maintain a live view of entitlements across the GCC, where small policy shifts catalyze outsized capacity responses.

Conclusion

India’s aviation ascent is not just a story of growth, it’s a redefinition of how regions connect and collaborate. The nation’s expanding airports, modernizing fleets, and surging passenger volumes are transforming it into a central pillar of global aviation. Yet this rise remains deeply intertwined with the Middle East, whose hubs, carriers, and flight-support providers continue to anchor India’s global connectivity.

For Tahseen Aviation Services, this entrance represents more than operational cooperation; it is a shared vision for efficiency, safety, and reliability across two of the world’s most dynamic airspaces. As India’s aviation landscape matures, the synergy between the Indian and Middle Eastern markets will not only drive regional prosperity but also set a new benchmark for cross-border collaboration in global flight operations.

The sky between them is no longer a boundary, it is a corridor of opportunity, and Tahseen remains at the heart of it, ensuring every mission takes off with confidence and precision.