African aviation is no longer in recovery mode—it is entering a phase of structural expansion. This is fueled by economic stabilization, rebounding tourism, and infrastructure investments.

With new routes taking shape and operators tapping into latent demand across business, leisure, and diaspora travel, the narrative is shifting from “post-pandemic bounce-back” to forward-looking growth.

Events such as the Aviation Africa Summit in Kigali offers a timely backdrop. It brings together stakeholders poised to shape Africa’s aviation future just as the data indicates a broader upswing in commercial and cargo markets.

Passenger and Cargo Market Size

Passenger Traffic and Forecasts

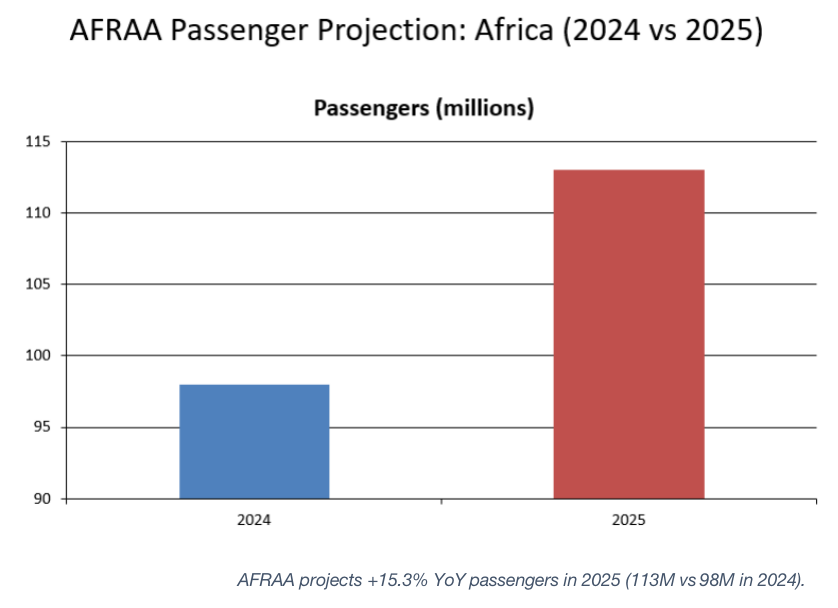

According to available data, African aviation growth? According to the African Airlines Association (AFRAA), African carriers are expected to transport 113 million passengers in 2025, up from 98 million in 2024, which is a robust 15.3% year-on-year increase.

This performance reflects structural, not temporary, growth, powered by new routes and operational improvements.

AFRAA projects +15.3% YoY passengers in 2025 (113M vs 98M in 2024)

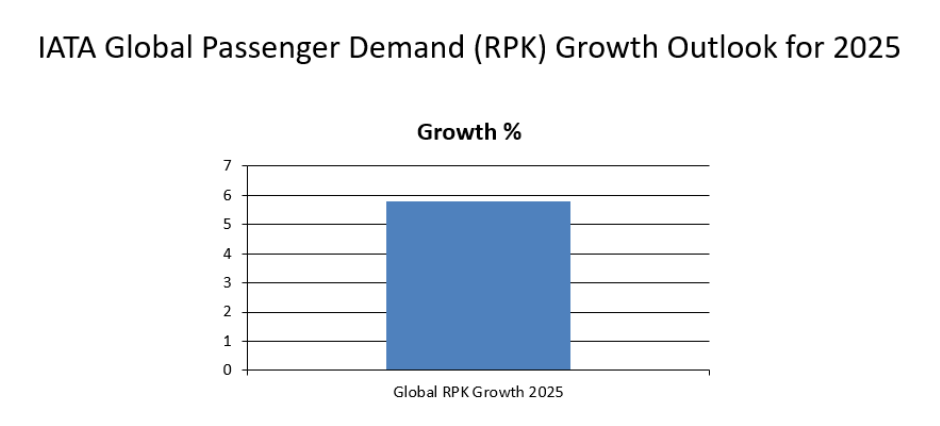

At the global level, IATA projects 5.8% growth in passenger demand (measured in RPK) for 2025, down from the exceptional gains of early post-pandemic years. Despite global normalization, Africa’s growth trajectory outpaces many regions, fueled by rising intra-continental and international travel.

IATA projects global RPK growth of 5.8% in 2025 (baseline for comparing Africa’s outperformance.

Cargo Trends

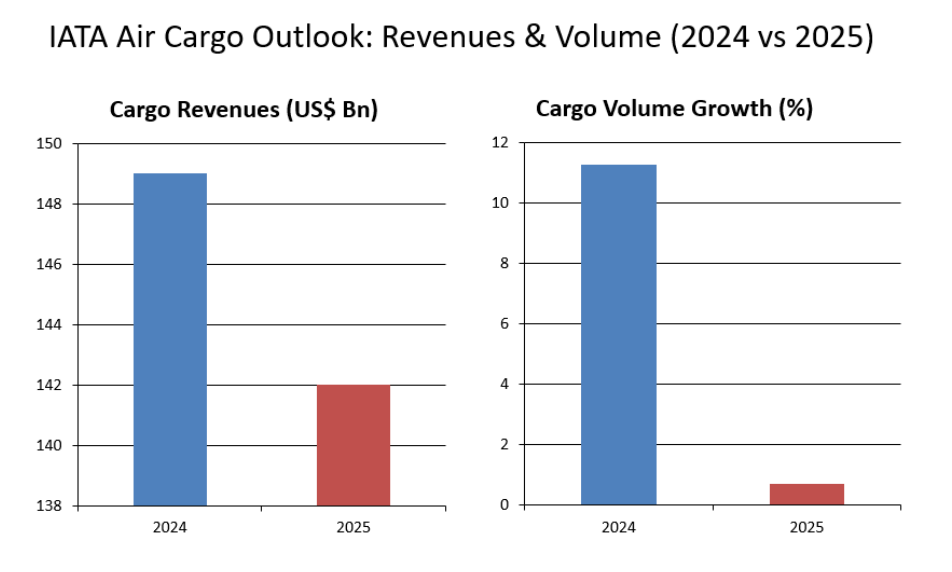

Cargo remains a critical enabler of trade, especially where ground infrastructure is weak. AFRAA’s data shows Eastern Africa accounts for 30% of the continent’s total cargo market share.

This is propelled by exports of perishables, horticulture, pharmaceuticals, and logistics-demanding goods. Yet challenges remain: global cargo revenues are expected to decline by ⁓4.7% in 2025, and volume growth is projected at just 0.7%, according to IATA. Partial recovery amid structural bottlenecks signals untapped opportunity for agile operators.

IATA (Jun 2025): 2025 cargo revenues expected at $142B (-4.7% YoY). Cargo volume growth to slow to +0.7% (vs +11.3% in 2024).

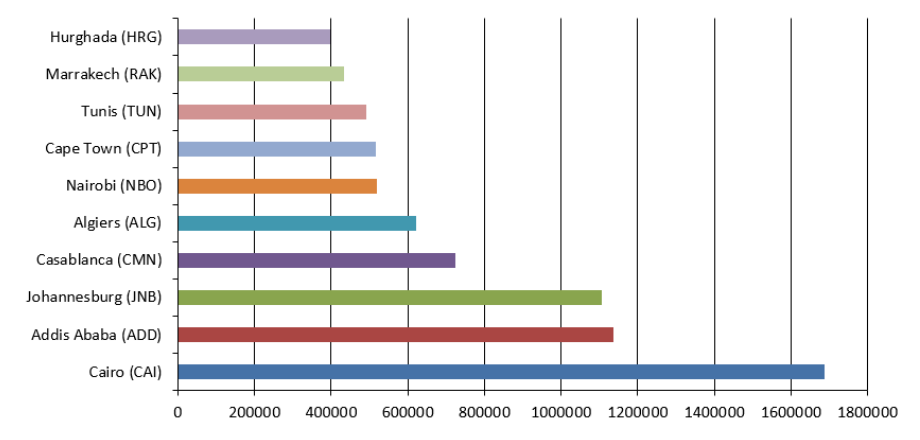

Busiest African Airports by Departing Seats (Aug 2025)

Africa’s growth is also evident in the concentration of traffic through some dominant hubs. The busiest airports on the continent anchoring regional and global connectivity.

The latest August 2025 data highlights how North, East, and Southern Africa continue to anchor the continent’s air travel networks.

Note: YoY change highlights: JNB (+11.7%), ADD (+7.3%), CMN (+5.3%), ALG (+8.4%), NBO (-1.5%).

- In August 2025, Cairo International Airport (CAI) retained its position as the continent’s busiest airport, with more than 1.7 million departing seats, reflecting Egypt’s strong mix of domestic leisure travel, regional connections, and long-haul services into Europe, the Middle East, and Asia.

- Close behind are Addis Ababa Bole International Airport (ADD) and Johannesburg O.R. Tambo International Airport (JNB), each handling just over 1.1 million departing seats. Addis Ababa benefits from Ethiopian Airlines’ extensive hub-and-spoke model, which continues to strengthen intra-African connectivity while serving as a key transit point for traffic between Africa, the Middle East, and Asia. Johannesburg, meanwhile, remains Southern Africa’s largest gateway, driven by South African Airways’ regional routes, private carriers, and sustained demand in both business and leisure travel.

- Casablanca (CMN) and Algiers (ALG) also feature prominently, reflecting North Africa’s competitive positioning. Casablanca, in particular, is Morocco’s largest international hub, supported by Royal Air Maroc’s transatlantic and European networks. Algiers plays a vital role in linking North Africa with southern Europe and the Mediterranean.

- Additionally, Nairobi (NBO) and Cape Town (CPT) continue to showcase East and Southern Africa’s dual strengths. Nairobi serves as a critical business and NGO hub with Kenya Airways’ strong African network, and Cape Town as a leading tourism and leisure gateway.

- North Africa’s Tunis (TUN) and Marrakech (RAK) are also climbing steadily, driven by a rebound in European tourism. Hurghada (HRG) completes the top ten, highlighting the strong resurgence of Egypt’s Red Sea leisure market

Regional Variations — East, West and Central Africa

1. East Africa

East Africa stands out with emerging aviation hubs and infrastructure momentum.

- Ethiopian Airlines continues its ascent, driving capacity growth. Addis Ababa is now a global connector.

- Rwanda and Kenya are improving connectivity: Kigali gains from investment, while Nairobi continues to consolidate regional links.

- Cargo leadership in Eastern Africa underscores its strategic weight.

2. West Africa

West Africa is showing green shoots of market maturity.

- Nigeria (Lagos) and Ghana (Accra) benefit from growing middle-class demand and regional trade flows.

- Air Peace’s remarkable expansion (+53% YoY capacity) reflects this dynamic shift, positioning West Africa as a rising regional power.

3. Central Africa

Although smaller in scale, Central Africa holds strategic promise.

- Market focus remains on humanitarian, diplomatic, and mining-related charter activity.

- Regulatory and infrastructure weaknesses are more pronounced here, but for operators with local expertise, this means an untapped opportunity.

Regulatory environments vary across subregions from the relatively liberal East African air policies to West Africa’s patchwork of restrictions and fee regimes.

Expansion Beyond the Continent

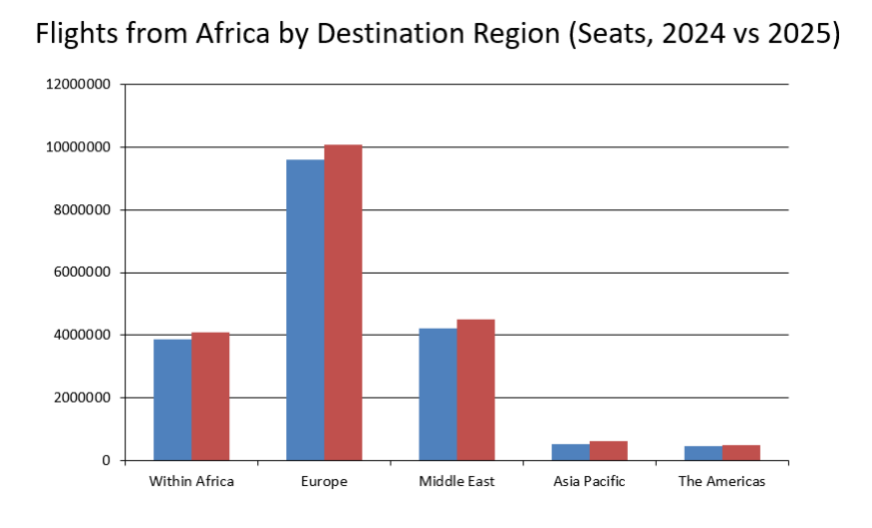

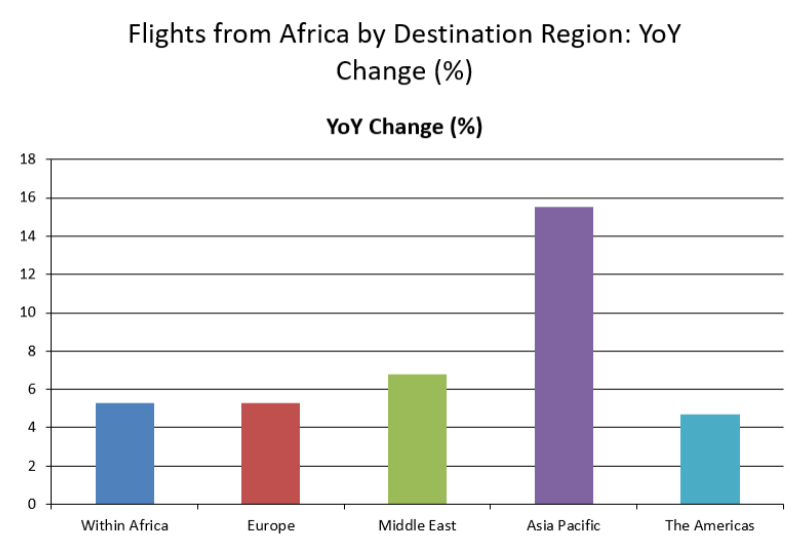

Asia Pacific shows the fastest growth from Africa (+15.5%), followed by the Middle East (+6.8%)

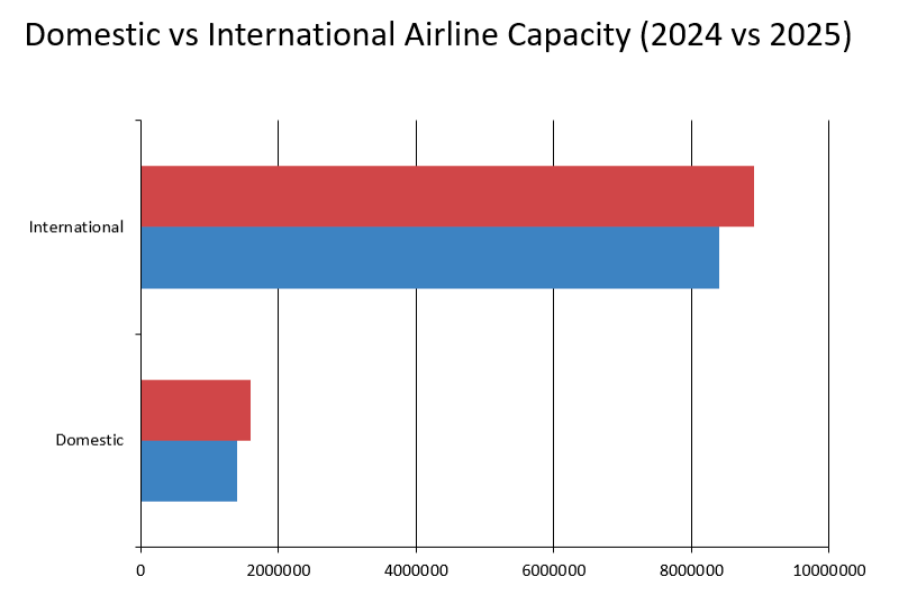

When looking at where Africa’s airlines are flying, the data shows a steady outward expansion. In August 2025, seat capacity grew 5.3% within Africa, reflecting stronger regional integration and more intra-African connectivity.

At the same time, routes to Europe (+5.3%) and the Middle East (+6.8%) continue to underpin Africa’s role in long-haul travel, supported by both legacy partnerships and Gulf hub connections.

The standout growth came from Asia Pacific (+15.5%), a sign of deepening economic and tourism ties with China, India, and Southeast Asia. Even the Americas market grew modestly (+4.7%), suggesting that African carriers are steadily diversifying their long-haul networks while balancing strong intra-continental demand.

Charter and Cargo Opportunities

Charter Growth

Charter aviation is expanding rapidly across Africa, serving:

- Business leaders in finance and resources sectors.

- NGOs, UN agencies, and government delegations.

- Emerging high-value tourism circuits, such as safari and event travel.

Cargo Expansion

Air cargo is thriving in key segments such as:

- Perishables (fruits, flowers) especially from East Africa.

- Pharmaceuticals and medical supplies, critical in humanitarian and rural regions.

- E-commerce — with online retail rising in urban markets like Nairobi, Lagos, and Dakar.

Humanitarian needs ranging from medical outreach to election logistics add an urgent charter dimension for cargo and pax operators alike.

For operators, Africa represents a compelling growth frontier—yet one that demands flexibility, local insight, and diversified service offerings.

What This Means for Operators and Partners

Challenges to Expect:

- Complex permit regimes — vary widely by country and flight type.

- Limited airport infrastructure — from handling assets to parking, especially off-mainline hubs.

- Fragmented regulatory frameworks — different bilateral policies, permit deadlines, and air navigation rules.

How a Partner Like Tahseen Adds Value:

- Swift Permit Processing: Expert handling ensures routes remain operational, even on short notice.

- Ground Handling and Supervision: On-the-ground support across East, West, and Central hubs ensures seamless operations.

- VVIP and Charter Concierge Services: Tailored solutions for diplomats, corporate clients, and humanitarian agencies.

- Cargo Support: Handling temperature sensitive, e-commerce, or oversized/urgent shipments.

Tahseen enables operators to capture growth opportunities with reduced operational friction. Let’s discuss how you can expand strategically under one operational, compliant, and effective umbrella.